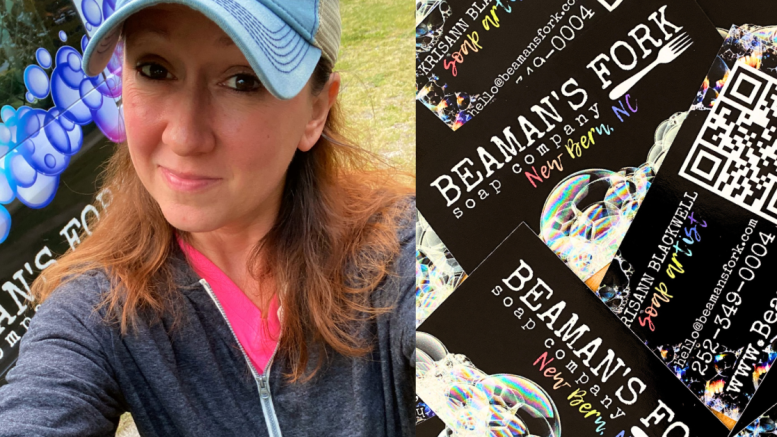

Soapmaking With a Goat and Print-Powered Twist

In this edition of PrintRunner’s customer stories, we meet Krisann, a skilled soapmaker who turned a hobby into a thriving business. Let’s get to know her story and see how PrintRunner’s expertise helped them become…

Read More